Collision repair insurance covers external damage to vehicles, with providers assessing and facilitating repairs for safety and quality. Understanding coverage types like comprehensive vs. collision simplifies claims and costs for issues like scratches, hail, and autobody work. Deductibles, out-of-pocket expenses before insurance, vary; lower deductibles offer less risk but higher premiums, while higher deductibles reduce monthly payments but increase out-of-pocket costs. Additional charges may include rental car fees or non-essential parts. Reputable collision repair shops provide transparent assessments, estimates, and communication for fair, pre-collision condition restoration at competitive costs.

In the event of a vehicle accident, understanding insurance and collision repair cost coverage is crucial. This comprehensive guide aims to demystify the process, helping you navigate the complexities with confidence. We’ll delve into what’s covered by collision repair insurance, explore deductibles and out-of-pocket expenses, and provide effective strategies for estimating and managing repairs. By the end, you’ll be equipped to make informed decisions regarding your vehicle’s restoration and financial obligations.

- What Is Covered by Collision Repair Insurance?

- Understanding Deductibles and Out-of-Pocket Expenses

- Navigating Estimation and Repairs Process Effectively

What Is Covered by Collision Repair Insurance?

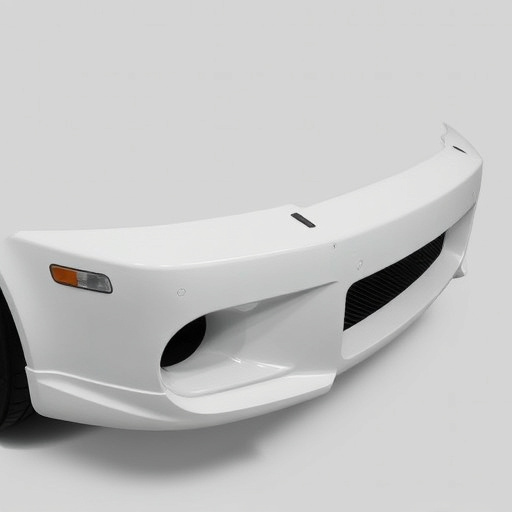

Collision repair insurance covers a range of damages that occur to your vehicle due to external impacts or accidents. This includes fixes for both structural and cosmetic issues, such as bent frames, cracked windshields, and damaged panels like fenders or doors. When you file a claim with your insurance provider, they will assess the extent of the damage and help facilitate the collision repair cost, ensuring that repairs are made to a safe and acceptable standard.

Understanding what’s covered can make navigating the process smoother. For instance, comprehensive coverage typically includes repairs from incidents like animal encounters, falling objects, or vandalism, whereas collision coverage primarily deals with accidents involving another vehicle or stationary object. This distinction is crucial when it comes to car scratch repair, hail damage repair, and autobody repairs, ensuring that you’re not left with unexpected out-of-pocket expenses for these types of incidents.

Understanding Deductibles and Out-of-Pocket Expenses

When navigating the world of insurance and collision repair cost coverage, understanding deductibles is key. A deductible is a predetermined amount that policyholders must pay out-of-pocket before their insurance covers the rest of the collision repair costs. This can significantly impact the overall financial burden of an unexpected vehicle accident. It’s important to choose a deductible that balances risk and savings, as lower deductibles may result in higher premiums, while higher deductibles can reduce monthly payments but require larger out-of-pocket expenses during claims.

Out-of-pocket expenses, beyond the deductible, refer to any additional costs not covered by insurance. These can include things like rental car fees during repairs or parts that are considered non-essential for safety. At an auto collision center, customers should be prepared for these potential charges and understand what their policy specifically covers in terms of collision repair cost coverage, especially when compared to the services offered by a vehicle collision repair specialist or automotive restoration expert.

Navigating Estimation and Repairs Process Effectively

Navigating the estimation and repairs process for a collision-damaged vehicle can be daunting, but understanding the steps involved can help car owners make informed decisions about their automotive repair needs. The first step is to visit a reputable collision repair shop where skilled technicians assess the damage, providing an accurate diagnosis of what needs fixing. This involves detailed inspections, often using advanced diagnostic tools, to identify issues with the vehicle’s frame, body panels, and other components. Once the scope of work is clear, the shop offers a transparent estimate outlining the collision repair cost, detailing labor and material expenses.

Effective communication between the owner and repair shop is vital. Owners should inquire about potential hidden costs, the quality of parts used in vehicle body repair, and warranty information. Reputable shops will be open about their processes, ensuring customers are comfortable with every step. By staying involved throughout the process, car owners can ensure their vehicles are restored to pre-collision condition at a fair collision repair cost.

Understanding insurance and collision repair cost coverage is essential for any vehicle owner. By grasping what’s covered under collision repair insurance, how deductibles work, and navigating the estimation process, you can manage your expenses effectively. Remember, being informed allows you to make sensible decisions when faced with collision repairs, ensuring peace of mind on the road.